Hear that? It’s the sound of millions of taxpayers cheering across the country: the Internal Revenue Service (IRS) has announced the open of the tax filing season. That date is February 12, 2021.

If you want to get your refund as fast as possible, the IRS recommends that you e-file your tax return and use direct deposit (be sure to double-check those account numbers before you send your return). If you file by paper, it will take longer. According to the IRS, eight out of 10 taxpayers get their refunds by using direct deposit.

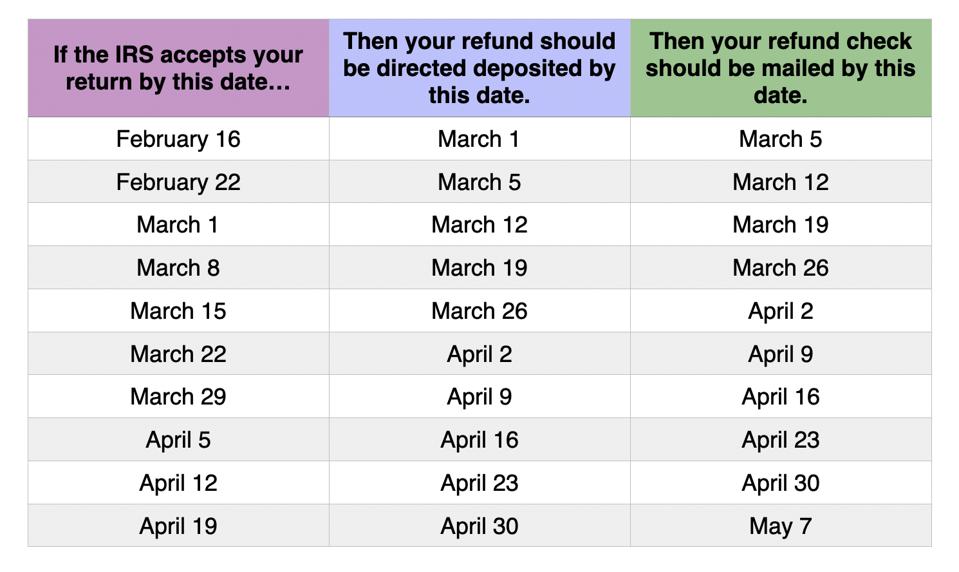

Assuming no delays, here are my best guesses for expected tax refunds based on filing dates and information from the IRS. I can’t stress enough that these are simply educated guesses. I like math and charts as much as the next girl, but there are a number of factors that could affect your tax refund

KPE

* No matter when you filed your tax return, if you claimed the EITC or the ACTC, don’t forget to take into consideration that hold date.

My numbers are based on an expected IRS receipt date beginning on the open of tax season, February 12, 2021, through the close of tax season on April 15, 2021. To keep the chart manageable, I’ve assumed the IRS received your e-filed tax return on the first business day of the week; that’s usually a Monday, but if there’s a holiday (like President’s Day), I’ve skipped ahead until Tuesday. The same logic holds true for issuing refunds. In reality, the IRS issues tax refunds throughout the week, so the date could move forward or backward depending on the day your return was received.

Other sites may have different numbers but remember they’re just guessing, too: The IRS no longer makes their tax refund processing chart public.

Do not rely on any tax refund chart—this one included—for date-specific planning like a large purchase or a paying back a loan.

Remember that if you claim the earned-income tax credit (EITC) and the additional child tax credit (ACTC), the IRS must wait until February 15 to begin issuing refunds to taxpayers who claim the EITC or the ACTC (that’s pretty close to the start date). Don’t forget to consider regular processing times for banks and factor in weekends and the President’s Day holiday. The IRS expects to see tax refunds begin reaching those claiming EITC and ACTC during the first week of March for those who file electronically with direct deposit and there are no issues with their tax returns.

If you want to get your tax refund as fast as possible, the IRS recommends that you e-file your tax return and use direct deposit. Keep in mind that if you e-file, the day that the IRS accepts your return may not be the day that you hit send or give the green light to your preparer. Check your e-filing confirmation for the actual date that the IRS accepts your return.

If you file by paper, it will take longer. Processing times can take more than four to six weeks in the best of times (and these are not the best of times) since the IRS has to manually input data. Don’t forget about postal holidays, too, when counting on the mail. There’s just one official postal holiday during tax season, Monday, February 15 (President’s Day), and one that follows just after tax season, Monday, May 31 (Memorial Day).

Even if you request direct deposit, you may still receive a paper check. Since 2014, the IRS has limited the number of refunds that can be deposited into a single account or applied to a prepaid debit card to three. Taxpayers who exceed the limit will instead receive a paper check. Additionally, the IRS will only issue a refund by direct deposit into an account in your own name, your spouse’s name or both if it’s a joint account. If there’s an issue with the account, the IRS will send a paper check.

If you’re looking for more information about the timing of your tax refund, don’t reach out to your tax professional. Instead, the IRS encourages you to use the “Get Refund Status” tool. Have your Social security number or ITIN, filing status and exact refund amount handy. Refund updates should appear 24 hours after your e-filing has been accepted or four weeks after you mailed your paper return. The IRS expect that the refund tool will be updated for those claiming EITC and ACTC, beginning on February 22, 2021. Otherwise, the IRS updates the site once per day, usually overnight, so there’s no need to check more than once during the day.

If you’re looking for tax information on the go, you can check your refund status with IRS2Go, the official mobile app of the IRS. The app includes a tax refund status tracker.

Remember that the IRS will not contact you by phone or by email regarding your refund. If you receive a call from someone claiming to be from the IRS or a debt collection agency regarding your tax refund, hang up immediately: it is a scam.

Source: forbes.com